If you’re selling a business, buckle up! The tax burden can be a shock.

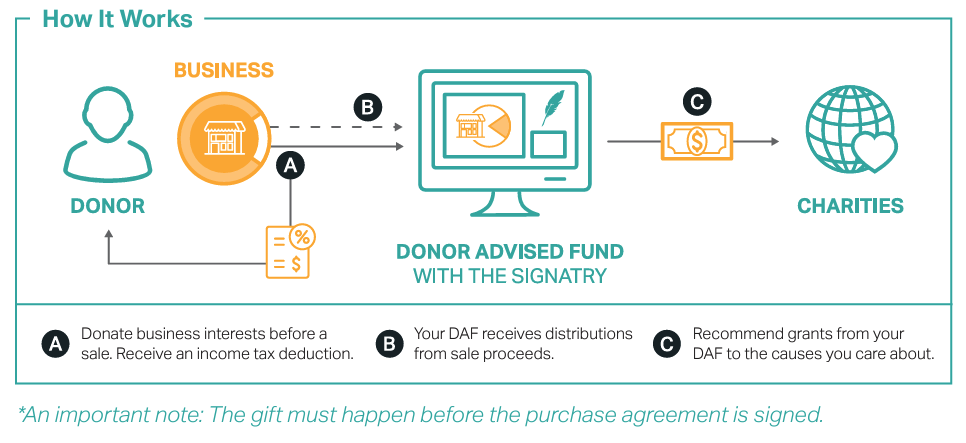

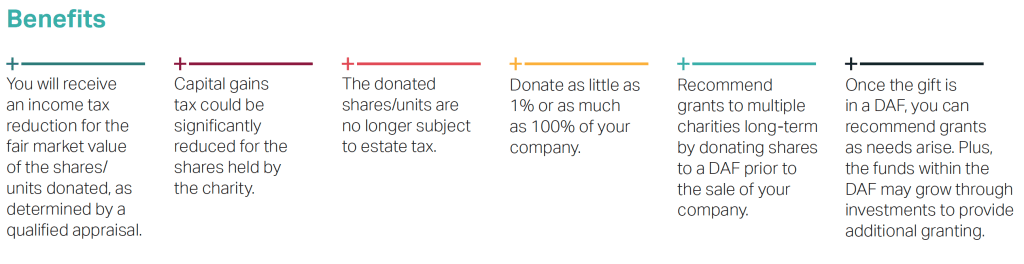

However, there is a proven solution that allows this liquidity event to become a great opportunity to benefit your favorite causes while increasing your tax deduction and minimizing capital gains taxes. By donating business interest to a donor advised fund (DAF) before the sale, these tax savings allow you to give more to charities beyond the initial interest donation.

CSNTM partners with The Signatry and other reputable firms to make setting up and maintaining a donor-advised fund (DAF) quick and simple.

Then, donating from your DAF via Overflow becomes a snap!

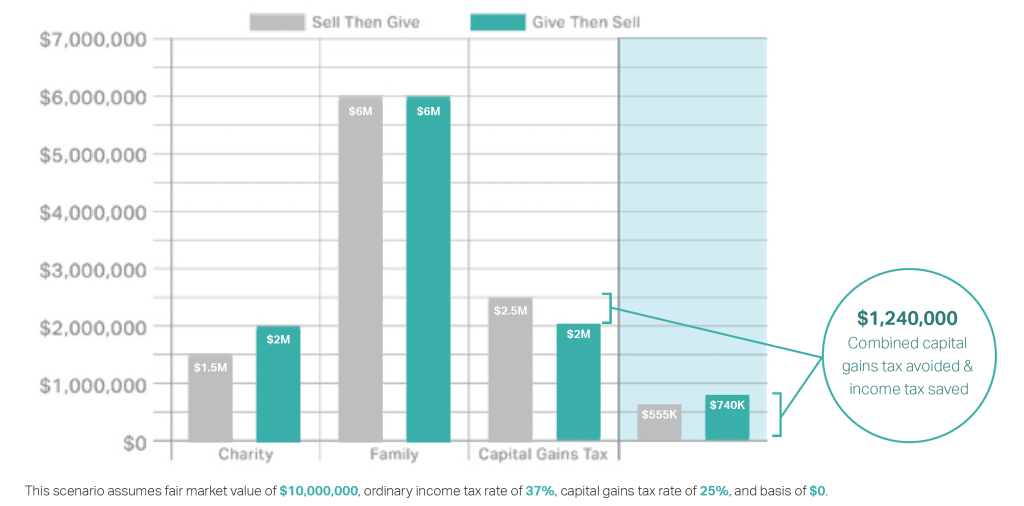

Here is a practical example: suppose a family sold their business for $10 million, and made a gift of 20% to their favorite cause. Here is a comparison if they made the gift before the sale rather than donating the proceeds after.