If you’re planning to sell real estate (a home, farmland, oil and gas interest, etc.) slow down! Consider the impact on your capital gains tax liability!

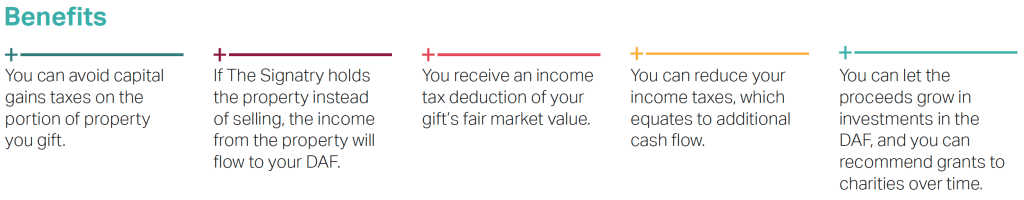

The opportunity to utilize real estate for charitable giving is often overlooked because it is assumed the assets are not easily liquidated. But by giving all or a partial interest in appreciated real estate, you can minimize capital gains taxes and receive an income tax deduction, and give more to CSNTM or your other favorite charities.

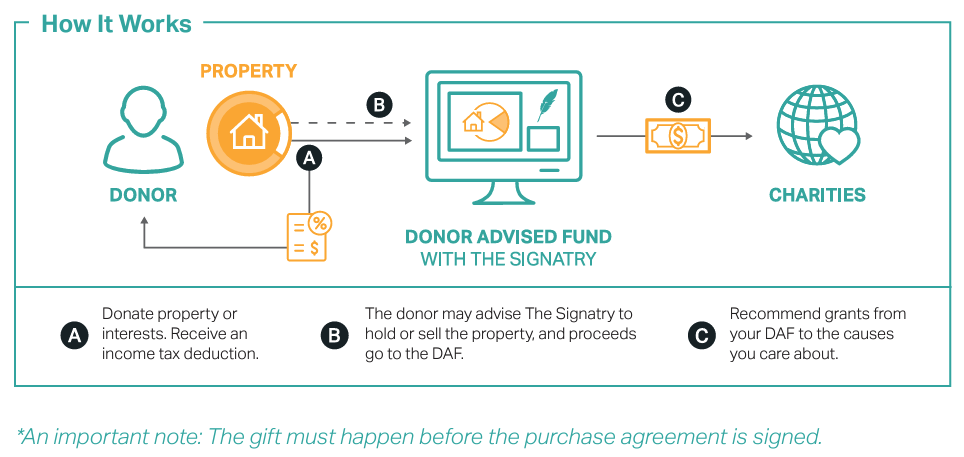

Before you sell your real estate, consider giving a portion of it to a donor advised fund. We partner with The Signatry and other reputable firms, which will process the gift and then direct the proceeds to your chosen causes.

Our partner, Overflow, will make your DAF donation quick and simple!

In a practical sense, consider the example of property with a fair market value of $1,000,000 with a basis of $100,000 and no debt. If you wanted to give all of the proceeds to charity, you can maximize the gift and reduce your tax burden by donating the real estate before it is sold.